Non-fungible tokens (NFT), crypto-auctions and last waves of bitcoin trading are the toys for digital natives and punters, according to a crypto-trading platform.

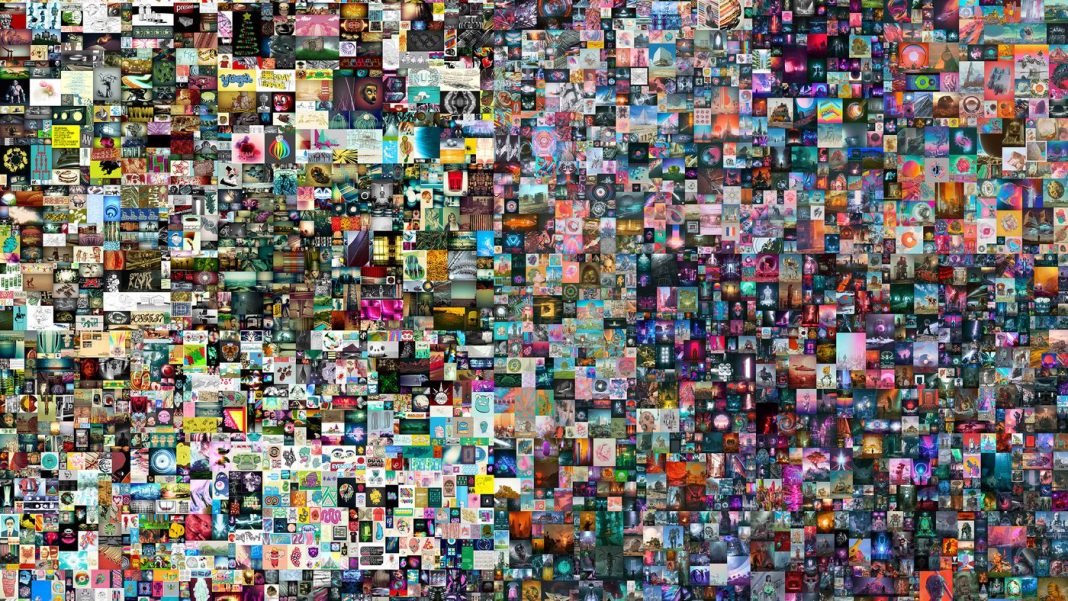

In March this year, an Indian blockchain entrepreneur revealed himself as the mystery buyer who paid a record US$69.3m for a digital art piece comprising just a collage of 5,000 images. He wanted to prove that Indians and people of color can be patrons of the Arts.

The technology that facilitated the digital auction— non-fungible tokens (NFT), uses the same blockchain technology behind cryptocurrencies, to verify ownership of anything from an art piece to sports trading cards. People are using NFT to monetize digital art of all kinds.

Another trend in blockchain-powered transactions is investments in cryptocurrency by millennials (those aged between 25 and 40). Many people of this age group have built up sufficient savings and may wish to skip the use of banks as they — according to one study in 2018 — feel that such institutions favor the rich and powerful. Hence, drawn by the potential high returns of cryptocurrencies, these young adults prefer to adopt cryptocurrency.

Facilitating blockchain commercialization

These trends have driven the growth of a blockchain industry, and one cryptocurrency trading platform is riding high on them. According to the CEO of ABCC Exchange, Alan Li: “Millennials like new experiences and are more inclined to trade cryptocurrency. That is why we are also inclined to beef up our security and develop a friendly-to-use trading platform that gives users the confidence to trade and with ease.”

ABCC will be launching improvements on its trading platforms to include flexible payment systems and diverse spot trading pairs to cater to the evolving demand of an estimated 1.8 billion new cryptocurrency and NFT investors and millennials.

To-date, 18.6 million bitcoins are in circulation, and since there is a cap of 21 million bitcoins built into the cryptocurrency’s mining model, speculators have rushed to capitalize on its skyrocketing market trading value, which recently hit a new high of more than US$60,000. This has, in turn, popularized speculation in alternative cryptocurrencies and blockchain-secured investment schemes.